Conversation

Notices

-

LinuxWalt (@lnxw48a1) {3EB165E0-5BB1-45D2-9E7D-93B31821F864} (lnxw48a1@nu.federati.net)'s status on Thursday, 13-Jul-2023 16:20:09 UTC  LinuxWalt (@lnxw48a1) {3EB165E0-5BB1-45D2-9E7D-93B31821F864}

LinuxWalt (@lnxw48a1) {3EB165E0-5BB1-45D2-9E7D-93B31821F864}

https://www.fool.com/investing/2023/07/12/the-easy-part-of-the-fight-against-inflation-is-ov/

> It's easy to understand why some investors have been quick to declare victory over inflation. The broadest CPI measure climbed just 0.2% for the month of June, which was less than many economists had projected for the month. June's reading brought the year-over-year inflation rate to just 3%, which is the lowest for that measure in more than two years.

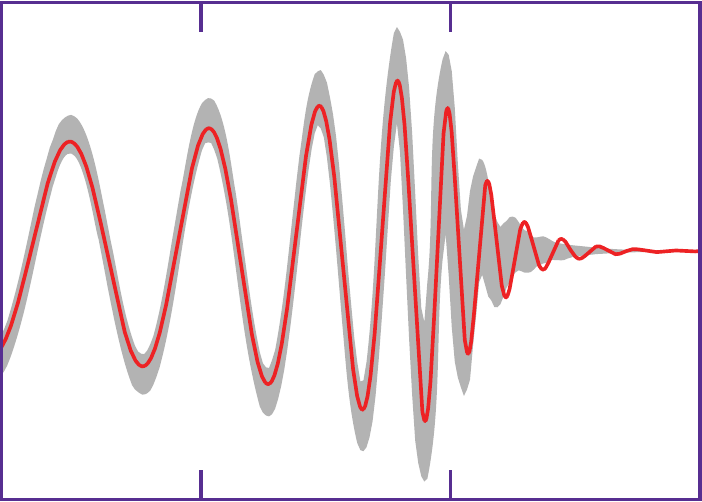

The easy part of the fight against inflation is over, says The Motley Fool. Last year's inflation surge ended after June, so annualized moving averages lost a big upward component. And energy price deflation probably ending also. After this, cutting measured price inflation will mean tackling underlying issues.

> As optimistic as investors were, there are plenty of reasons to remain concerned about inflation. Even with the decline in monthly core inflation rates, the year-over-year rise there was still 4.8%. That's more than double the Fed target.

> For those who prefer the broader CPI measure, it's important to recognize that the overall figure got a big push downward from a 16.7% plunge in energy prices over the past year. It's not out of the realm of possibility that prices for gasoline, heating oil, and other energy products could continue to fall, but it's more likely that energy will stop exerting so much downward pressure on overall CPI numbers from here on out.

I think we're getting things confused. Price inflation is generally a symptom and effect of inflation itself. Inflation is generally stated as an increase in the money supply that is in excess of population growth and GDP growth.

In response to more money being available, sellers raise prices. Or if they do not, buyers buy more stuff, and sellers raise prices until economic growth and population growth match the increased money supply. So prices can surge because (1) "money printer go brrrr" or because (2) more demand, but 'widget' output remains the same.

We really need for articles covering !econusa to distinguish between inflation (the money printing issue) and price inflation (which is usually an effect thereof). Educate your readers, so they'll understand how various policy choices can affect them. Even the current Fed chair (Jerome Powell) and the secretary of the treasury (Janet Yellen) seem to confuse the two, but that may be their way of not acknowledging that it was primarily their actions that spawned this cycle of increased prices.