Notices where this attachment appears

-

LinuxWalt (@lnxw48a1) {3EB165E0-5BB1-45D2-9E7D-93B31821F864} (lnxw48a1@nu.federati.net)'s status on Thursday, 29-Dec-2022 23:49:11 UTC  LinuxWalt (@lnxw48a1) {3EB165E0-5BB1-45D2-9E7D-93B31821F864}

LinuxWalt (@lnxw48a1) {3EB165E0-5BB1-45D2-9E7D-93B31821F864}

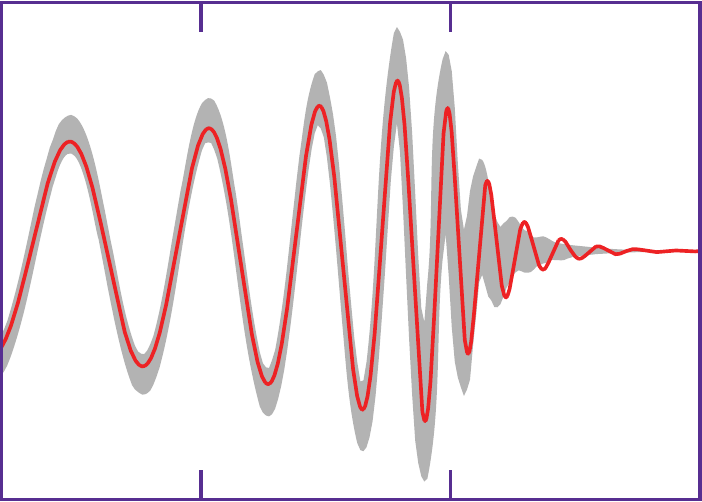

The "Yard Sale":{https://pudding.cool/2022/12/yard-sale/} model is a generalized #economic model that helps to explain the emergence of super-rich people in the economy as something that can happen by pure chance if the system does not redistribute enough wealth (not just income!).

Why not just income? Because a lot of wealth comes about by purchasing some appreciating asset and then holding it while its value increases. The value of shares in $CORPORATION may rise even if it doesn't pay out dividends (e.g., no income to the shareholders), who may not sell for decades. In the meantime, the stock's selling price times the number of shares held gives a wealth value that can be borrowed against, despite the shareholder(s) not having received that value as income. In the simulations on the site, income would be the funds gained from interacting / gambling / trading with others, but wealth would be the amount stored in each person's wallet.

> Currently in the US, the wealthiest 20% of families own about 70% of wealth. But this doesn't capture the true wealth disparity in the US: If the US population was represented by 1,000 people in a room, the richest one person would have four times more money than the poorest 500 people.

* https://pudding.cool/2022/12/yard-sale/

* https://www.cbo.gov/system/files/2022-09/57598-family-wealth.pdf [www cbo gov]

* https://www.federalreserve.gov/releases/z1/dataviz/dfa/distribute/table/

* https://www.vox.com/policy-and-politics/2019/11/4/20938229/zucman-saez-tax-rates-top-400

* https://www.sciencedirect.com/science/article/pii/S037843711730081X

> Americans pay a lot of taxes, and the rich are usually taxed more than the poor. And for the most part, that money is used for government programs that usually help the poor more than the rich.

I disagree there. For example, when there's a "public benefit" project, your city / county / state doesn't knock down the mini-mansions in the rich part of town, they knock down homes and apartments in the lower-income areas. A big part of government spending goes into activities that stimulate selected business organizations, which are rarely owned by lower-income people or minorities. Even things like the Affordable Care Act wind up lining the pockets of big insurance companies and leaving lower-income people paying for care out-of-pocket because of insurance denials.

More references are at the bottom of the article. I think I'm going to try to read more about this topic.

!econusa

Chirp! is a social network. It runs on GNU social, version 2.0.1-beta0, available under the GNU Affero General Public License.

![]() All Chirp! content and data are available under the Creative Commons Attribution 3.0 license.

All Chirp! content and data are available under the Creative Commons Attribution 3.0 license.